Current Executive Webinars

The University for Peace (UPEACE), the Terrorism, Transnational Crime and Corruption Center (TraCCC) at the George Mason University, and the Anti-Illicit Trade Institute (AITI) are pleased to offer the online Summer Certificate Course on Combating Transnational Organized Crime and Illicit Trade: Networks, Dynamics, and Social Impact. It will be held from August 5–15, 2024, and convened by the University for Peace (UPEACE), and the Terrorism, Transnational Crime and Corruption Center (TraCCC), and the Anti-Illicit Trade Institute (AITI) at George Mason University.

The course aims to improve students’ comprehension of the dynamics of transnational organized crime, focusing on money laundering, corruption, illicit trade, security, trade zones, state fragility, and the UN Sustainable Development Goals (Agenda 2030). The main objective of the course is to identify how different types of crimes impact the capacity of the state to manage and mitigate internal and external threats. The course will also push participants to think about organized crime from a more nuanced perspective, specifically as an aspect of social conflict, emphasizing that the challenges for promoting peace are embedded in local, regional, and global contexts. Students will receive a certificate upon successful completion of the course.

The course aims to improve comprehension of the networks, dynamics, and social impact of transnational organized crime, including a focus on: geopolitics and organized crime; corruption; money laundering; counterfeits and illicit trade; criminalized hubs and free trade zones; environment and transnational security; investigative journalism; human mobility; the role of civil society to counter corruption and organized crime; and peace, human rights, and the UN Sustainable Development Goals (Agenda 2030). Summer Course professors are professionals, experts, and researchers with a range of expertise across related disciplines.

Summer Course participants will receive a certificate upon successful completion. They will have the opportunity to work in groups and present a case study at the end of the course. The cost of the course is USD 500, to be submitted to UPEACE. Below is a flyer with a QR code to access information about the course, registration, and contact email. For additional information and for any questions, please email: [email protected].

What participants said about the 2023 Summer Certificate Course:

“The course provided greater insights into the new facets of transnational crimes.”

“Very current and exciting content.”

“It was interesting that the professor provided information that is not in

academic papers”

“Very knowledgeable and insightful session. The shared materials were

excellent too!! I spent several hours poring over all of these useful materials.”

DATE: August 05 to August 15, 2024

PRICE: US$500

REGISTRATION: Click here

from 6:00 – 7:30 p.m. EST

Concluded Executive Webinars

July 31 – August 10, 2023

The second edition of the online Summer Certificate Course on Combating Transnational Organized Crime and Illicit Trade: A Focus on the Americas

The course aimed to improve students’ comprehension of the dynamics of transnational organized crime, focusing on money laundering, corruption, illicit trade, security, trade zones, state fragility, and the UN Sustainable Development Goals (Agenda 2030). The main objective of the course is to identify how different types of crimes impact the capacity of the state to manage and mitigate internal and external threats. The course will also push participants to think about organized crime from a more nuanced perspective, specifically as an aspect of social conflict, emphasizing that the challenges for promoting peace are embedded in local, regional, and global contexts. Students received a certificate upon successful completion of the course.

August 22 – August 26, 2022

COURSE NAME: Combating Transnational Organized Crime and Illicit Trade: A Focus on the Americas

COURSE DATE: August 22 – August 26, 2022

WHERE: Zoom Webinar

PRICE: $200 USD

TraCCC and the AITI offered a new summer course, jointly hosted by UPEACE & TraCCC-AITI, on Combating Transnational Organized Crime and Illicit Trade: A Focus on the Americas, which was taught in English by security experts from both the region and Washington, D.C.

The 1-week innovative certificate course took place virtually from the 22nd to the 26th of August 2022 and had a fee of $200 USD.

Course Overview

The course aimed to improve students’ comprehension of the dynamics of transnational organized crime, focusing on money laundering, corruption, illicit trade, security, free trade zones, state fragility, and the UN Sustainable Development Goals (Agenda 2030).

The main objective of the course was to identify how different types of crime impact the capacity of the state to manage and mitigate internal and external threats. The course also pushed participants to think about organized crime from a more nuanced perspective, specifically as an aspect of social conflict, emphasizing that the challenges for promoting peace are embedded in local, regional, and global contexts.

Course Schedule

Day 1

Session 1: Opening Ceremony and Course Introduction

Day 2

Session 2: Transnational Organized Crime Groups Business Elites

Session 3: Following Dirty Money and Value Trails

Session 4: Counterfeits and Illicit Trade

Day 3

Session 5: State Fragility and Organized Crime

Session 6: SDG 16 and Corruption

Session 7: Environment and Organized Crime

Day 4

Session 8: Free Trade Zones (FTZs) and Illicit Economies

Session 9: New Trends in Transnational Organized Crime

Session 10: Team Building Activity

Day 5

Session 11/12: Group Presentations/Joint Staff Discussion/Closing

April 5-May 5, 2022

Trade-Based Money Laundering (TBML) and Illicit Financial Flows: AML/CFT Controls, Countermeasures, Operations, and Practical Steps

COURSE NAME: Trade-Based Money Laundering (TBML) and Illicit Financial Flows: AML/CFT Controls, Countermeasures, Operations, and Practical Steps

COURSE DATE: April 5th – May 5th, 2022

TIME: Tuesdays and Thursdays, 4:00pm-5:00pm EST

WHERE: Zoom Webinar

PRICE: $549 for the general public. Government personnel received a discount of $50 off, for a total cost of $499. Current full-time GMU graduate students (non-government employees) qualified for a reduced price of $200.

Online Course & Certificate

This online course emphasizing TBML countermeasures, operations, and practical steps was taught by two internationally-recognized experts on TBML and Anti-Money Laundering and Countering the Financing of Terrorism (AML/CFT), John Cassara (former U.S. Treasury Special Agent and author) and Lakshmi Kumar (Policy Director, Global Financial Integrity). David M. Luna (former U.S. State Department official, co-Director of TraCCC-AITI) and Dr. Louise I. Shelley (University professor and Omer L. and Nancy Hirst Endowed Chair at the Schar School of Policy and International Affairs at George Mason University and founder and executive director of TraCCC), along with Peter Wild (FCA, CAMS, and trade finance specialist) served as guest instructors.

The instruction was in “real time” where students logged in to the virtual class on GMU’s platform. The course focus was on more concrete outcomes than previous AITI classes. The course ran consecutively for five weeks; two sessions a week. Students that successfully completed this executive development webinar received a certificate from the Anti-Illicit Trade Institute of the Terrorism, Transnational Crime, and Corruption Center (TraCCC), Schar School of Policy and Government, George Mason University.

Overview

The International Monetary Fund (IMF) has estimated that money laundering comprises approximately 2 to 5 percent of the world’s gross domestic product (GDP) each year, or approximately $2 trillion to $4.5 trillion. Many experts believe that the actual magnitude of international money laundering is probably much higher depending upon what is included in the count. For example, if forms of trade fraud, underground financial systems, and tax evasion were included the estimated amount of money laundered worldwide would be far higher. Across numerous illicit economies and global finance hubs including in Canada, China, Singapore, UAE, UK, the United States, and other countries TBML and illicit finance continue to grow significantly.

Money laundering (illicit finance) and trade-based money laundering are threat multipliers that help criminals and threat networks finance greater harms and insecurity across communities around the world. The reality is that dirty money derived from illicit commerce remains the lifeblood of today’s kleptocrats, criminal organizations, and terrorist groups who engage in greed crimes such as human trafficking, wildlife trafficking, environmental and natural resource degradation and exploitation, illicit trade in counterfeit and pirated goods, illegal alcohol and tobacco, financial frauds, and a plethora of other crimes.

Money laundering is international in scope. Criminals and criminal organizations are attracted to the weak link. The lack of anti-money laundering and counter terrorist financing (AML/CFT) enforcement in one country can affect many countries and many industries across borders.

Increasingly, AML/CFT and national security experts acknowledge that TBML and value transfer in all its many forms is probably the largest and most widespread money laundering methodology. It is also the least understood, recognized, and enforced. In this course, experts discussed TBML and related subjects. The emphasis of the course was on presenting AML and TBML controls, countermeasures, operations, and discussing practical steps that can be taken to help mitigate this growing worldwide threat.

Course Highlights and Features

Throughout the course, the instructors emphasized practical insights on what works and what does not in combatting TBML based on professional experiences accumulated over decades in policy and law enforcement circles. Select topics were measured against effective international standards such as those by the Financial Action Task Force (FATF), AML measures, and accepted best practices. This course provided practical information on understanding how TBML and value transfer works. We discussed the magnitude of the problem and presented many case examples. The course also introduced service-based money laundering (SBML).

Illicit financial flows (IFFs) generally refer to cross-border movement of capital associated with illegal activity. Global Financial Integrity (GFI) estimates that the developing world is losing over $1 trillion every year via IFFs. We explored how trade mis-invoicing is the major component of IFFs – perhaps accounting up to 80 percent of IFFs that can be measured using available data. Various sources of information to combat TBML were reviewed including HUMINT, financial intelligence, and trade documents. We discussed the status of the international Trade Transparency Unit (TTU) initiative – a subject recently reviewed by Congress’s Government Accountability Office (GAO). There was an entire module dedicated to new technologies such as crypto currencies and how they impact TBML.

Trade finance is an important component of TBML countermeasures. Financial institutions’ best practices, risk management and governance framework were reviewed as well as U.S. and U.K. guidance to address illicit shipping and sanctions evasion. Analysis of trade data can provide fascinating insights into the underworld of transnational crime and illicit trade hubs. Experts from TraCCC provided excellent examples from research using concrete examples.

Illicit financial and trade hubs including FTZs must be confronted in international efforts to combat TBML. The course also examined that role of corrupt and complicit enablers of money laundering and financial crime. Technical countermeasures such as artificial intelligence, block chain, and distributed ledger technology provide great promise in providing trade transparency and countering the illicit use of cryptocurrencies. Such methods can assist law enforcement and corporate actors in disrupting illicit financial flows derived from corruption, organized crime, and threat networks. Both the instructors and students had ample opportunities to present their personal views and observations and pose and answer questions.

The training webinar was aimed for professionals in all sectors and industries impacted by illicit finance and TBML. Topics covered in this five-week course over 10 sessions included the following:

Week 1:

i. TBML – Magnitude, Description, and Challenges; John Cassara

ii. Illicit Financial Flows – Illegal movement of Money and Capital; Lakshmi Kumar

Week 2:

iii. Sources of Information and Trade Data Analysis; Lakshmi Kumar and John Cassara

iv. New Technologies that Facilitate TBML – Lakshmi Kumar

Week 3:

v. Trade Finance and Risk Management – Peter Wild

vi. Analysis of Trade Fraud and Case Examples – Dr. Louise I. Shelley and TraCCC staff

Week 4:

vii. Illicit Financial Hubs, Illicit Trade, and Free Trade Zones (FTZs) – Lakshmi Kumar, Dr. Louise I. Shelley and David M. Luna

viii. Technology and other Countermeasures – John Cassara, Lakshmi Kumar and Peter Wild

Week 5:

ix. Operations, Case Studies, and Practical Steps – Instructor Panel Discussion; moderated by David M. Luna

x. Practical Applications II: Student and Instructor Q&As and General Discussion

Throughout the five weeks, students were challenged to share experiences and advance imaginative solutions and practical steps to counter TBML. All Zoom sessions featured online chat functions and time was reserved at the end of the presentations for questions. Students were able to follow-up via email or telephone conversation with the instructors. All presentation materials were made available for review outside of class.

[60 minutes per session; two (2) sessions per week for five (5) weeks. Spring 2022]

October 12-November 11, 2021

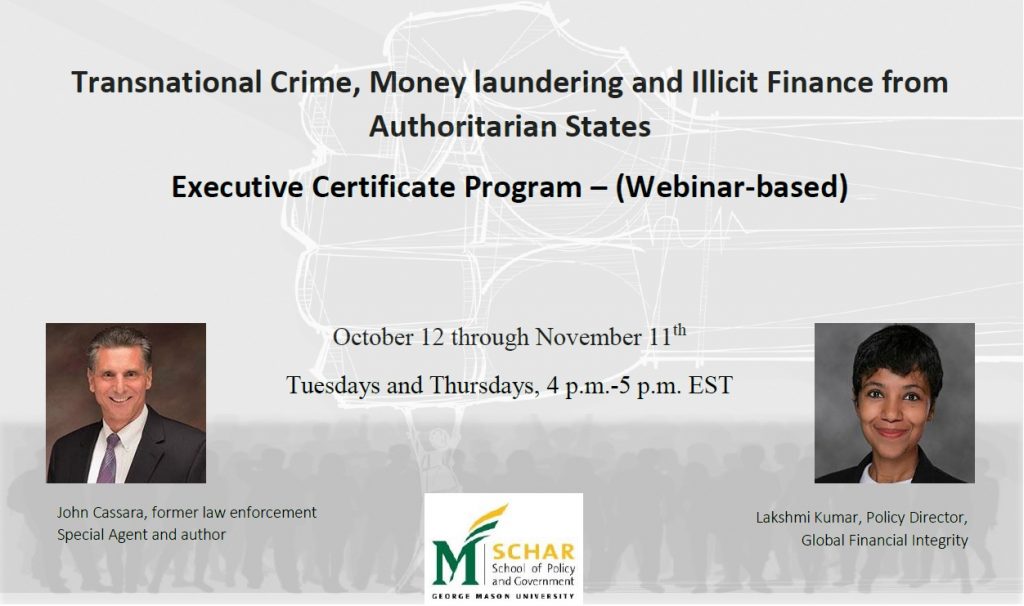

Transnational Crime, Money Laundering & Illicit Finance from Authoritarian States

COURSE NAME: Transnational Crime, Money laundering and Illicit Finance from Authoritarian States

COURSE DATE: October 12th – November 11th, 2021

TIME: Tuesdays and Thursdays, 4:00pm-5:00pm EST

WHERE: Zoom Webinar

CREDITS: Participants received a Schar School TraCCC certificate of completion and earned 1.5 CEUs (Continuing Education Units)

Online Course & Certificate

This online course on Transnational Crime, Money Laundering, and Illicit Finance from Authoritarian States focused on understanding the differences in laundering between China and Post-Soviet states. Money-laundering from these authoritarian states is the subject of much legislation under consideration by Congress. This course was taught by two internationally-recognized experts on AML/CFT, John Cassara (former US law enforcement Special Agent and author) and Lakshmi Kumar (Policy Director, Global Financial Integrity). David Luna (former U.S. State Department official) and Dr. Louise Shelley (University professor and Omer L. and Nancy Hirst Endowed Chair at the Schar School of Policy and International Affairs at George Mason University and founder and executive director of TraCCC) were also guest instructors as well as Andrew McCabe, former deputy director of the FBI. The instruction was in “real time” where students logged in to the virtual class on GMU’s platform. The sessions were recorded so that if students were unable to join live, they were able to later review content. Students that successfully completed this executive development webinar received a certificate from the Anti-Illicit Trade Institute of the Terrorism, Transnational Crime, and Corruption Center (TraCCC), Schar School of Policy and Government.

Overview

The International Monetary Fund (IMF) has estimated that money laundering comprises approximately 2 to 5 percent of the world’s gross domestic product (GDP) each year, or approximately $1.74 trillion to $4.35 trillion. The amount of illicit funds is steadily increasing. Dark money and finance pose direct threats to societal stability, governments, and the global financial system.

China is the factory to the world. It is a producer of both large amounts of licit commodities as well as illicit— including counterfeits, fentanyl and precursor chemicals for illicit narcotics. To help drive its economic growth, it is a major importer of illicitly harvested timber, IUU fish, rare-earth minerals and many other illegally obtained commodities. Therefore, it generates massive revenues from its participation in the licit and the illicit economies. Post-Soviet authoritarian states are not major producers of goods. Therefore, their involvement with trade-based money laundering (TBML) is confined primarily to natural resources and the transit of goods such as narcotics. Both China and Russia utilize cyber-criminal enterprises to target western governments and private sector entities in ways to advance the nations’ strategic interests. The proceeds from these crimes must be laundered.

Money laundering consists of hiding the proceeds of transnational crime as measured by predicate offenses or specified unlawful activities. Both the Organization for Economic Development and Global Financial Integrity have released influential reports examining the top sectors of transnational crime. In both reports, China figures prominently. China’s economy is based on production and trade and is now the world’s largest trading nation. Its role in illicit trade requires it to rely heavily on trade-based money laundering.

Although the numbers are not precise and, in some cases, do not exist, the bottom line is that a strong argument can be made that China is responsible for introducing and laundering approximately $1.5 – $2 trillion of illicit funds into the world’s economy every year as measured by predicate offenses. Another way of looking at the magnitude of the problem is that approximately one-half of the total amount of money laundered worldwide is of Chinese origin. China also provides money laundering services to the Mexican drug cartels and have developed their own laundering methodologies.

In 2021 the U.S. Department of State calls “The People’s Republic of China (PRC) a global hub for money laundering.” According to an Atlantic Council Report, Russia has the world’s largest volume of dark money hidden abroad—about $1 trillion—both in absolute terms and as a percentage of its national GDP.

For many reasons, including a lack of linguistic capacity and cultural understanding, there are a limited number of criminal investigations and criminal cases of Chinese and Post-Soviet transnational crime that follow the money and value trails. Unfortunately, these investigations are hindered as these countries consistently fail to cooperate with other countries in resolving cross-border money laundering and other financial crimes.

Just as international trade in the past helped China develop a sophisticated system of underground banking, China along with Russia is a world leader in “new payment” systems of transferring money and value including but not confined to cryptocurrencies. Many observers believe Chinese and Post-Soviet involvement in illicit trade is encouraged or tolerated to help achieve state ambitions. This course asked the question: Is transnational crime (and resulting money laundering) a form of asymmetric warfare of authoritarian states?

Course Highlights and Features

This was the first known academic course that examined authoritarian states’ role in international money laundering.

This course focused on Chinese and Post-Soviet illicit trade, money laundering and illicit finance. At the same time, it provided information on understanding how money laundering works, current issues, trends and methodologies used by today’s bad actors. It contrasted the forms of Chinese money laundering with that used in the post-Soviet successor states.

Post-Soviet states have TBML tied almost entirely to natural resources, drugs, illicit tobacco and human trafficking whereas Chinese are involved involvement in all these forms of illicit trade and in addition, counterfeit goods, state-sponsored intellectual property rights violations, and trade fraud.

Chinese centric enablers for money laundering include underground banking, “flying money,” investment in real estate, casinos, state-sponsored identify theft, bribery and corruption, the use of offshore secrecy jurisdictions, and others.

The instructors shared practical insights on what works and what does not by examining effective international standards such as those by the Financial Action Task Force (FATF), AML measures, best practices, and case studies in detecting and preventing the laundering of dirty money. This course also focused on TBML, underground financial systems, free trade zones (FTZs), black market exchanges, new payment methods, and other illicit finance processes, vehicles and methods that enable bad actors to disguise and clean their dirty money.

The training webinar was designed for professionals in all public and private sectors and industries impacted by illicit finance and China and other authoritarian states.

Topics covered in this five-week course over 10 sessions included the following:

Week 1:

I. Introduction to Transnational Crime, Money laundering and Illicit Finance from Authoritarian States Context and Perspective; Dr. Louise Shelley and Andrew McCabe.

II. Chinese and Post-Soviet Illicit Trade as Predicate Offenses for Money Laundering; John Cassara

Week 2:

III. Enablers of Money Laundering from Authoritarian States; John Cassara

IV: Trade-based Money Laundering and Illicit Financial Flows with a Comparison of China with other Regions; Lakshmi Kumar

Week 3:

V: Chinese and Post-Soviet New Payment Methods including the digital yuan, bitcoin and other cryptocurrencies, Underground Banking, and Flying Money; John Cassara

VI: Global Trade and Free Trade Zones with a Focus on China and Post-Soviet states; Lakshmi Kumar

Week 4:

VII. Corruption and Money Laundering into Real Estate (Dirty Money) with a Focus on China and Post-Soviet investment in the U.S., Canada, Australia, the U.K., and other locales; David Luna, Lakshmi Kumar, and Dr. Louise Shelley

VIII. Transnational Crime and Fentanyl and Chinese money laundering for Mexican cartels, Northern Drug Route out of Afghanistan through Central Asia and Russia; Dr. Louise Shelley

Week 5:

IX: Chinese Mercantilism, Exploitation, and the Creation of Debt Traps; John Cassara

X: Practical exercises and discussion; all instructors

60 minutes per session; two sessions per week for five weeks. Fall 2021

About the Instructors

John Cassara began his 26-year government career as a covert intelligence officer during the Cold War. He later served as a Treasury Special Agent in both the U.S. Secret Service and US Customs Service where he investigated money laundering, trade fraud, and international smuggling. He was an undercover arms dealer for two years. Assigned overseas in the Middle East, he developed expertise in money laundering, value transfer, and underground financial systems. He also worked six years for the Treasury’s Financial Crimes Enforcement Network (FinCEN) and was detailed to the Department of State’s Bureau of International Narcotics and Law Enforcement Affairs. Mr. Cassara’s final assignment was with the Treasury’s Office of Terrorism and Financial Intelligence (TFI). Since his retirement, he has lectured in the United States and around the world on a variety of transnational crime issues. He has been a consultant for government and industry, and is currently on the Board of Directors of Global Financial Integrity. Mr. Cassara has authored and co-authored several articles and books. His latest publications include Trade Based Money Laundering: The Next Frontier in International Money Laundering Enforcement (Wiley 2016) and Money Laundering and Illicit Financial Flows: Following the Money and Value Trails (Amazon/KDP 2020). More information is available at www.JohnCassara.com.

Lakshmi Kumar is the Policy Director at Global Financial Integrity (GFI), a Washington, D.C.-based think tank specializing in research, advocacy, and advisory services. Ms. Kumar works on issues of illicit finance and trade, and the vehicles, systems, and institutions that facilitate movement of illicit money across borders. She has spoken as a subject matter expert on issues including illicit gold trade, trade-based money laundering, kleptocracies, the abuse of anonymous shell companies, and the integrity risks of Sovereign Wealth Funds. Ms. Kumar has spoken publicly on these subjects at Capitol Hill, the OECD, the Atlantic Council, the Carnegie Endowment for International Peace, and various other think tanks in D.C., as well as venues in Africa and South America. As a legal expert, she has contributed through her authorship to reports of institutions including the United National Economic Commission of Africa and the Carnegie Endowment for International Peace. Prior to joining GFI, Ms. Kumar was a lawyer and policy professional in India, working with governments and regulatory agencies across South Asia, East Africa, and Eurasia to investigate money laundering and terrorist financing risks in their financial systems.

October 20-November 19, 2020

Illicit Finance and Trade Based Money Laundering Executive Webinar

This course (which ran from October 20th to November 19th) provided information on understanding how money laundering works, current issues, trends, and methodologies used by today’s bad actors – once having accumulated money from an array of illicit activities – who hide, disguise, and launder so that authorities cannot determine where the dirty money comes from. The instructors shared practical insights on what works and what does not by examining effective international standards such as those by the Financial Action Task Force (FATF), AML measures, best practices, and case studies in detecting and preventing the laundering of dirty money. This course also focused on trade-based money laundering (TBML), underground financial systems, black market exchanges, new payment methods (NPMs), and other illicit finance processes, vehicles, and methods that enable bad actors to disguise and clean their dirty money.

The training webinar was designed for professionals in all sectors and industries impacted by illicit finance and TBML.

Topics covered in this five-week course over 10 sessions included the following:

Week 1:

i. Introduction to Money Laundering (Understanding Illicit Finance)

ii. Illicit Financial Flows

Week 2:

iii. Trade Based Money Laundering (TBML)

iv. Misuse of the International Gold Trade

Week 3:

v. Underground Financial Systems

vi. Black Market Exchanges

Week 4:

vii. Free Trade Zones (FTZs)

viii. Offshores and Safe Havens (Illicit Cash)

Week 5:

ix. TBML: Government and Industry Countermeasures

x. Practical Exercises

Throughout the five weeks, students were challenged to work through the various methodologies to think of ways to develop potential solutions to target the numerous money laundering threats using the materials and instruction provided throughout the course.

[60 minutes per session; two (2) sessions per week for five (5) weeks. Fall 2020]

For more information please visit https://schar.gmu.edu/prospective-students/programs/executive-education/illicit-finance-and-trade-based-laundering-executive-webinar